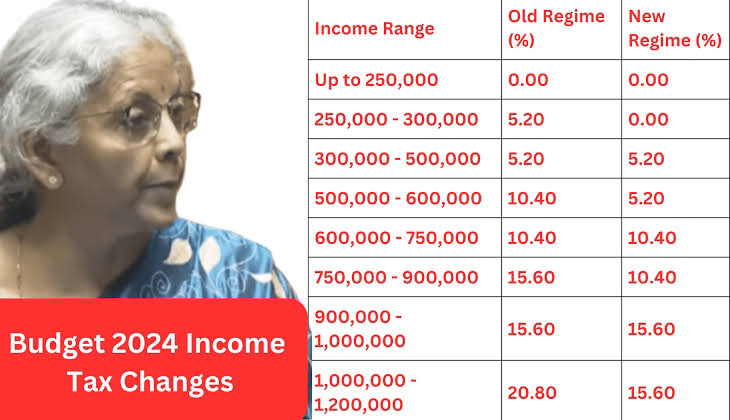

Here are new tax slabs the New Tax Regime

Rs 0-3 lakh: Nil (unchanged)

Rs 3-7 lakh: 5% (vs 5% for Rs 3-6 lakh before)

Rs 7-10 lakh: 10% (vs 10% for Rs 6-9 lakh before)

Rs 10-12 lakh: 15% (vs 15% for Rs 9-12 lakh before)

Rs 12-15 lakh: 20% (unchanged)

Above Rs 15 lakh: 30% (unchanged)

How much tax will you pay if your salary is Rs 7.75 lakh

In the full Budget 2023, the Centre made adjustments to the income tax structure. Specifically, the income rebate threshold under the New Tax Regime was raised from Rs 5 lakh to Rs 7 lakh. Furthermore, the standard deduction of Rs 50,000, initially applicable only to salaried taxpayers and pensioners, was expanded to encompass the new tax regime. Consequently, individuals with an income of up to Rs 7.5 lakh were exempt from income tax liabilities. The FM tweaked this a bit further and with the increase in the Standard Deduction to Rs 75,000. As a result, individuals with annual incomes of up to Rs 7.75 lakh will now enjoy a tax-free status.

Here's the breakup

Annual Income: Rs 7.75 lakh

Standard deduction: Rs 75,000

Total taxable income: Rs 7 lakh

Tax on income up to Rs 3,00,000- Nil

Tax on Income Rs 3,00,001 - Rs 7,00,000: 5% or rs 20,000

Rebate under section 87A- Rs 25,000

Annual Income: Rs 10 lakh

Individual taxpayers with an annual income of up to Rs 10 lakh will have to pay Rs 42,500 as tax under the revised new tax regime. The breakdown includes a Standard Deduction of Rs 75,000, resulting in a taxable income of Rs 9,25,000, as per Upstox calculations.

For this income bracket,

Tax on Rs 3,00,000 is Nil

Tax on Income Rs 3,00,001 - Rs 7,00,000 is 5% or Rs 20,000,

Tax on Rs 7,00,001 - Rs 9,25,000 is 10% or Rs 22,500.

The total applicable tax is Rs 42,500.

Annual Income: Rs 12 lakh

Individuals with an annual income up to Rs 12 lakh will have to pay a total income tax of Rs 68,750 under the revised new tax regime, compared to Rs 82,500 previously.The total income earned is Rs 12,00,000 with a standard deduction of Rs 75,000, resulting in a taxable income of Rs 11,25,000. For this income range, the tax calculation is as follows:

Tax on Rs 3,00,000 - Nil

Tax on Rs 3,00,001 - Rs 7,00,000: 5% or Rs 20,000

Tax on Rs 7,00,001 - Rs 10,00,000: 10% or Rs 30,000

Tax on Rs 10,00,001 - Rs 11,25,000: 15% or Rs 18,750

Hence, the total applicable tax amounts to Rs 68,750.

Annual income: Rs 20 lakh

According to the new income tax regulations, individuals earning an annual income of ₹20,00,000 will now be liable to pay ₹2,67,500 in taxes, in comparison to the previous amount of ₹2,85,000.

Breakdown of Tax Calculation:

Total Income: Rs 20,00,000

Standard Deduction: Rs 75,000

Taxable Income: Rs 19,25,000

Tax on Rs 3,00,000 - Nil

Tax on Rs 3,00,001 - Rs 7,00,000: 5% or Rs 20,000

Tax on Rs 7,00,001 - 10,00,000: 10% or Rs 30,000

Tax on Rs 10,00,001 - Rs 12,00,000: 15% or Rs 30,000

Tax on Rs 12,00,001 - Rs 15,00,000: 20% or Rs 60,000

Tax on Rs 15,00,001 - Rs 19,25,000: 30% or Rs 1,27,500

Total applicable tax: Rs 2,77,500

0 Comments